Last week, I attended a webinar, titled: Retail buying in uncertain times, aimed at multi-brand retailers of fashion and sporting goods.

Multi-brand retailers buy from the brands and sell to consumers in a seasonal rhythm, where a season lasts roughly 26 weeks, including the sale period, where ‘everything must go’. The cash to cash cycle between concept and shelf is often more than a year so the retailers are highly dependent on the accuracy of their sales forecast. Inaccurate forecasts lead to stock-outs and redundancy, which in turn leads to lost sales and markdowns. Brands compensate the retailers for this uncertainty with high mark-ups and discounts and manufacturers keep their costs low by producing big batches with long lead-times, paying low wages and generally disregarding the negative effects of an ‘efficient’ manufacturing process on our planet.

Multi-brand retailers buy from the brands and sell to consumers in a seasonal rhythm, where a season lasts roughly 26 weeks, including the sale period, where ‘everything must go’. The cash to cash cycle between concept and shelf is often more than a year so the retailers are highly dependent on the accuracy of their sales forecast. Inaccurate forecasts lead to stock-outs and redundancy, which in turn leads to lost sales and markdowns. Brands compensate the retailers for this uncertainty with high mark-ups and discounts and manufacturers keep their costs low by producing big batches with long lead-times, paying low wages and generally disregarding the negative effects of an ‘efficient’ manufacturing process on our planet.

Until twenty years ago, this Push model led the whole industry. The problem with this model is that when the forecast is wrong, there is not much you can do to prevent huge margin losses.

Enter the Pull model. Invented by the ‘verticals’, who control every stage in the planning, buying and distribution process. The pull model uses data to respond to changes in consumer demand and significantly reduce lead-times as well as stocks and risk in the value chain to retail. The last three months proved just how important that is…

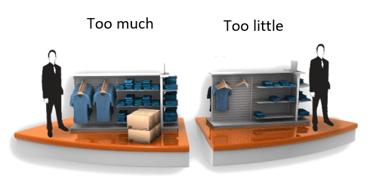

With reduced initial allocations and regular, frequent replenishment, the Pull model allows vertical retailers to tweak stock buffers continuously and significantly reduce the problem of ‘too much’ and ‘too little’, giving them a competitive edge.

Vendor Managed Inventory (VMI):

Independent brands and retailers are also ‘acting vertical’ to be more responsive. With VMI, brands use retail data to replenish stock to retailers and maximise sales and profits of the entire value chain. Retailer inventory is shared, or at least physically aggregated until the product ships to retail. Hence the scope of VMI tends to be limited to items with long shelf-lives that are distributed everywhere, like ‘never out of stock’, or ‘always available’ goods.

Even more value could be extracted from merchandise that is not distributed everywhere and is typically bought and ring-fenced in separate contracts long before the season starts. This is where the biggest problems of 'too much' and 'too little' occur. However, this requires that brands and retailers collaborate in the value chain the same way as verticals do. And this conflicts with their push-oriented business model. Or does it?

Another Perspective

Sixty years ago, in his article: “Marketing Myopia”, Theodore Levitt argued that when customers ask for a quarter inch drill, they are really looking for a quarter inch hole, as they want to have their pictures hung. More recently, Netflix realised that people don’t want to rent movies; they want to watch movies. And when transactional data can predict selections, fitting recommendations can be made. LinkedIn works the same way. So do Amazon and Facebook.

Sixty years ago, in his article: “Marketing Myopia”, Theodore Levitt argued that when customers ask for a quarter inch drill, they are really looking for a quarter inch hole, as they want to have their pictures hung. More recently, Netflix realised that people don’t want to rent movies; they want to watch movies. And when transactional data can predict selections, fitting recommendations can be made. LinkedIn works the same way. So do Amazon and Facebook.

From that perspective, independent multi-brand retailers don’t necessarily need to buy better. They need to respond better to consumer demand to reduce stocks and risk. Or rather: act vertical without being vertical. With assortments that appeal to those who come to buy.

Platform Retail

Just like Netflix knows which movies to recommend local viewers everywhere, brands can recommend relevant assortments to local consumers everywhere. Using data and platform technology. On a platform, brands and retailers can respond to local retail demand by dynamically adjusting local retail assortments and adjusting the flow of merchandise to retail, while respecting agreements and constraints of space, lead-times, pack-sizes and minimum order quantities. This reduces the retailer’s dependency on a long term forecast, which in turn leads to fewer shortages and more sales. With less stock. Everybody wins. Not least our planet.

.png?width=482&name=BlogImage1%20(1).png) No Push, No Pull, Just Flow.

No Push, No Pull, Just Flow.

At Retailisation, we deliver software as a service and expert customer support to optimise retail assortments everywhere. Via a platform that connects you with your retailers.

Synchronise the supply of merchandise with real retail demand and significantly improve sales, service and ‘return on inventory'.